Managing your finances effectively is an invaluable life skill, keeping us in control of our money and not falling into the all too easy trap of debt. Many of us have experienced the feeling of loss of control that accompanies spiralling debt, and the accompanying anxiety associated with it. If you do find yourself in this unenviable position, its always best to seek professional help. Unburdening yourself via the help of a professional can be very relieving.

Debt Support Service is available for you, providing fair and ethical consumer debt management. We expertise in helping people who are struggling with personal debt and financial problems, and are perfectly placed to help you find the right solution for your individual circumstance.

Debt management is a process designed to reduce and eventually clear you “unsecured debt” without the need to take out another loan, or risk collaterals such as your property or vehicle. Essentially it is an unofficial agreement with your creditors for the repayment of unsecured debt over a set period of time. Once you have agreed and committed to the plan, you’ll be required to pay your regular instalments to the debt management company.

Importance of debt management

- Firstly is the protection and wellbeing of your family. Unmanaged debt and the stress it can puts under, has the real potential of damaging our relationships to those around us, in some cases tragically leading to the breakup of the family unit, with the potential of children being adversely effected from the resulting fallout. Seeking debt management help at the earliest possible opportunity stands us in good stead to avoid the worst outcomes of uncontrollable debt.

- Secondly, debt management can help your physical health. Rising debts can lead to stress, insomnia, heart problems and exacerbate many other existing conditions. Taking professional help to manage your debt at the earliest opportunity will help to avoid any negative impact on personal health.

- Thirdly, bad debt management costs you money. By reducing fees and high interest rates you’re directly saving yourself money and shortening the time you are indebted. Think of how you and your family could benefit from the money saved.

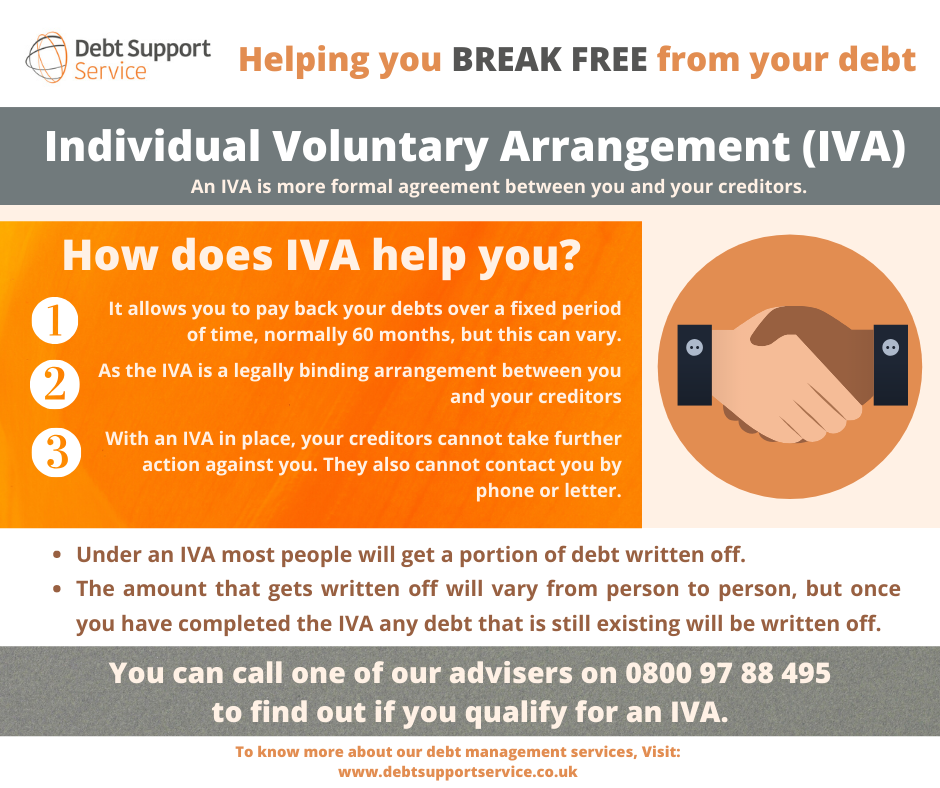

There are various options out there to help manage your debt issues. Of these, an Individual Voluntary Arrangement (IVA), is best suited to individuals looking for a formal alternative to bankruptcy.

What is Individual Voluntary Arrangement?

Individual Voluntary Arrangement (IVA) is a formal and legally binding agreement between you and your creditors to help you pay off your debts over a given period of time. It is approved by the court and your creditors have to abide by it.

How does an IVA work?

An IVA is arranged by an insolvency practitioner, they will typically be either a lawyer or an accountant. Based on the financial details provided by you (your debts, assets, income etc), an insolvency practitioner will propose a monthly figure that you’ll be required to pay and the duration that the arranged IVA will last. Creation of an IVA is successful if creditors holding 75% of your current debts agree to this arrangement. You will then enter into a legally binding arrangement, that any remaining creditors must also adhere to. An IVA will prevent your creditors from taking any action against you in the future, as long as you conform to the terms of your IVA.

Do I qualify for an IVA?

These are the qualifying IVA criteria:

- Have a minimum of £80 of spare income each month that can be used to pay your debtor.

- Have a minimum of two different debts.

- Have the ability to back a minimum of 5p for every £1 debt owed to your creditors.

Note that these are guidelines and each case will be assessed individually.

How much does an IVA cost?

The Insolvency Practitioner plays the role of the nominee and supervisor throughout the period of the IVA and both these services have an associated cost. These costs in detail are:

Nominee fee – a fee charged by the Insolvency Practitioner who proposed the IVA plan to your creditors.

Supervisor fee – after paying the nominee fee, any remaining funds would be used to pay a supervisor fee.

Disbursements – these are additional costs incurred during an IVA that are paid to third parties, such as insurance, registration fee, maintenance fees etc.

At Debt Support Service, we offer comprehensive debt management through fully trained and skilled advisers with an extensive track record in the industry. We can work with you to efficiently resolve your debt problems, reducing your anxiety and relieving you of your financial worries.